You’ve just driven your gleaming new car off the lot, the smell of fresh upholstery filling the air. It’s a moment of pure joy, until an unsettling thought creeps in: what if it gets totaled or stolen tomorrow? What if your insurance payout isn't enough to cover what you still owe? This very real concern is why many drivers consider gap insurance. But here’s the crucial question: When Gap Insurance Is Not Worth It for your car loan. Because for many, it's an unnecessary expense that offers little to no real protection.

Think of it like this: gap insurance is a safety net, but you only need a safety net if there's actually a gap to fall through. If your financial footing is already solid, that net becomes redundant. As a seasoned journalist who's seen countless car loan scenarios, I'm here to guide you through the decision-making process, helping you determine if this optional coverage truly belongs in your financial toolkit.

At a Glance: When You Can Confidently Skip Gap Insurance

- You made a substantial down payment (typically 20% or more) on your vehicle.

- Your loan term is short (e.g., 36 or 48 months), allowing you to build equity quickly.

- You own your vehicle outright – no loan or lease exists.

- You consistently owe less on your car than its current market value (actual cash value, or ACV).

- Your vehicle is known for holding its value exceptionally well, depreciating slowly.

- You already have "new car replacement" or "better car replacement" coverage through your primary insurer.

- You're financing an older, used car (gap insurance typically isn't available for vehicles over three years old).

Understanding the "Gap" – And Why It Matters Less for Some

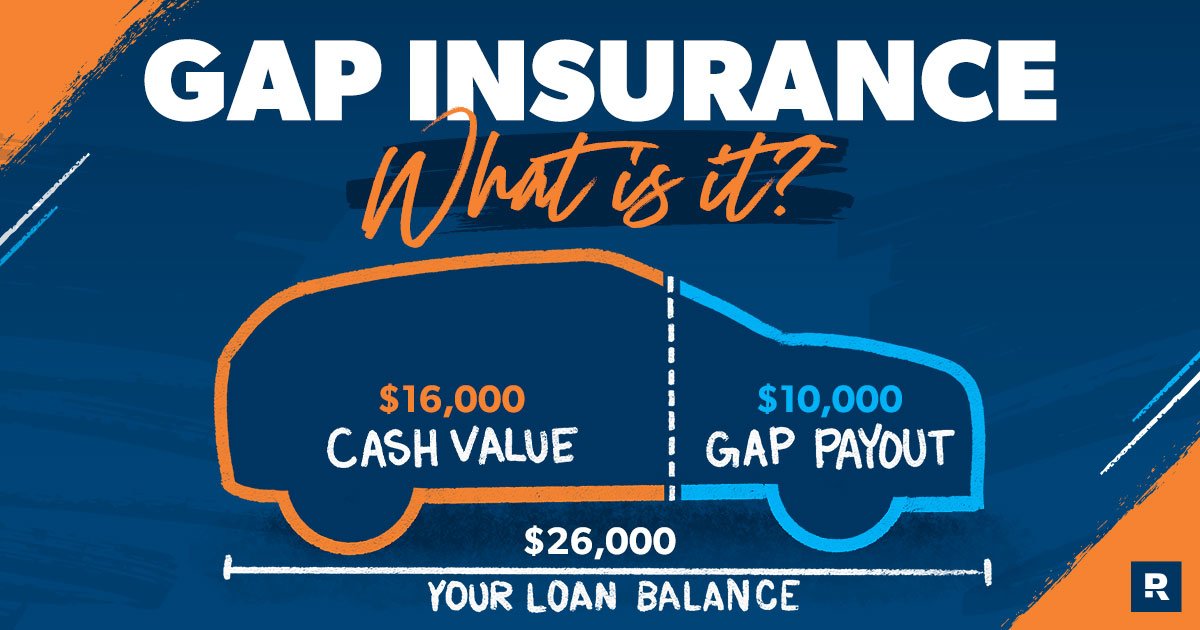

Before we dive into when to skip it, let's quickly clarify what gap insurance does. Often called "loan/lease coverage" or "loan/lease protection," it's an optional car insurance policy designed to shield you from "negative equity." Negative equity occurs when you owe more on your car loan or lease than the vehicle is actually worth.

Here’s the classic scenario: you buy a car, take out a loan, and drive it off the lot. Almost immediately, your car starts to depreciate, often by thousands of dollars in the first year alone. If that car is then declared a total loss (stolen or totaled in an accident), your standard collision or comprehensive insurance policy will only pay out the vehicle's Actual Cash Value (ACV) at the time of the loss, minus your deductible. If your ACV payout is $22,000 but you still owe $25,000 on your loan, you’re on the hook for that $3,000 difference. Gap insurance steps in to cover that remaining balance, saving you from making payments on a car you no longer own.

This protection is invaluable for certain drivers, particularly those who put little or no money down, finance for long terms, or roll negative equity from a previous loan into a new one. Some lenders might even require it. But for a significant portion of car owners, the circumstances just don't align with the need for this specific type of coverage. In fact, many people pay for it long after it stops being useful.

Your Decision Checklist: When Gap Insurance Offers Minimal Value

The core of determining gap insurance's worth lies in evaluating your personal financial situation and your vehicle's value. Here are the key indicators that tell you gap insurance might be an unnecessary expense.

1. You Made a Generous Down Payment (20% or More)

This is perhaps the most straightforward reason to forego gap insurance. A substantial down payment immediately reduces the initial amount you borrow, minimizing the gap between your loan balance and the car's depreciated value.

- Why it matters: Cars typically depreciate significantly in the first year – sometimes 15-20% or even more. If you start your loan with a large chunk of equity already in the car, you're less likely to go "underwater" (owe more than it's worth) even with that initial depreciation. A 20% down payment is often cited as a solid benchmark, but even more is better.

2. Your Loan Term is Short (e.g., 36 or 48 Months)

Longer loan terms mean smaller monthly payments, but they also mean you pay interest for a longer period and build equity at a slower pace. Conversely, shorter loan terms accelerate your equity growth.

- Why it matters: When you're making larger payments over a shorter period, a greater portion of each payment goes towards the principal of your loan. This allows your loan balance to decrease faster than the rate of depreciation, quickly bringing your outstanding balance below the car's actual cash value. A loan term of 60 months (5 years) or longer is where the risk of negative equity typically starts to climb.

3. You Already Have Positive Equity (Owe Less Than Your Car is Worth)

This is the ultimate indicator that gap insurance is no longer, or was never, necessary. If your vehicle's Actual Cash Value (ACV) is greater than your outstanding loan balance, there is no "gap" for the insurance to cover.

- Why it matters: Once you reach this point, any total loss payout from your primary insurer would be sufficient to clear your loan, and potentially leave you with some money left over. It's crucial to periodically assess your car's value against your loan balance. Many drivers pay for gap insurance for months or even years after they've crossed this positive equity threshold, essentially throwing money away. You can estimate your car's ACV using reputable online tools like Kelley Blue Book or NADAguides, and check your loan balance on your monthly statement or by contacting your lender.

4. You Own Your Vehicle Outright

This might seem obvious, but it's worth stating clearly. If you don't have a loan or lease on your vehicle, there's no outstanding balance to protect. Therefore, gap insurance is completely irrelevant to your situation. Congratulations on owning your car free and clear!

5. Your Vehicle Holds its Value Exceptionally Well

Some cars are depreciation magnets, plummeting in value the moment they leave the lot. Others are known for their strong resale value. The type of car you drive significantly impacts your risk of negative equity.

- Why it matters: Vehicles like the Porsche 911, Porsche 718 Cayman, and Toyota Tacoma are examples of models that tend to depreciate much slower than the average car. For instance, while the average car depreciates by nearly 39% after five years, these models hold their value far better. If you drive a car that retains its value, you're less likely to find yourself with a significant "gap" even after several years of ownership. Conversely, luxury cars such as certain Maserati or BMW models can depreciate over 60% in five years, making gap insurance more pertinent for them.

6. You Have "New Car Replacement" or "Better Car Replacement" Coverage

These alternative coverages, offered by some major insurers, can effectively replace the protective function of gap insurance, and often provide even more robust protection in the event of a total loss.

- New Car Replacement Coverage: This policy pays out enough to buy you a brand-new car of the same make and model if your vehicle is totaled or stolen, without deducting for depreciation. Insurers like Amica, Farmers, and Nationwide offer this, typically for vehicles under a certain age and mileage.

- Better Car Replacement Coverage: Offered by insurers such as Liberty Mutual and Horace Mann, this coverage goes a step further, reimbursing you for a newer or better model of your totaled car. This is exclusively for car owners, not lessees.

- Why it matters: If you have either of these coverages, the financial risk of a total loss is significantly mitigated, often to a greater degree than gap insurance alone, rendering gap coverage superfluous. It’s always smart to compare these options with a standalone gap policy. To understand more broadly if this type of insurance is generally worth it for people, you might explore articles like Is gap insurance worth it?.

7. You're Financing an Older Used Car

Gap insurance generally has strict eligibility requirements. It's typically only available for brand-new cars or vehicles that are only a few years old (often under three years).

- Why it matters: If you're financing a used car that's older than these typical age limits, gap insurance likely isn't even an option for you. And if it were, an older car has already undergone significant depreciation, potentially reducing the initial "gap" risk if financed wisely.

The Dynamics of Depreciation: Timing Your Gap Insurance Need

Vehicle depreciation is the silent engine behind negative equity. Understanding how and when your car loses value is key to timing your gap insurance needs.

The Rapid Decline: Early Depreciation

The moment a new car is driven off the lot, its value drops. This initial rapid depreciation is often the period when gap insurance is most critical. Factors like the vehicle make, model, market demand, and even color can influence this rate. Electric vehicles, for instance, generally depreciate faster (around 49.1% in five years) than hybrids (37.4%) and conventional cars, which average 38.8% in five years.

The Equity Crossover Point

The goal for any car owner with a loan is to reach the "equity crossover point"—the moment when your vehicle's actual cash value (ACV) finally exceeds your outstanding loan balance. Once you're here, you have positive equity.

- How long does it take? This varies greatly depending on your down payment, loan term, interest rate, and the car's depreciation rate. For a typical 60-month loan with a modest down payment, it might take 2-3 years to reach this point. With a large down payment and a short loan, it could happen within months.

How to Track Your Equity

Regularly checking your equity position is a smart financial habit.

- Find Your Loan Balance: Refer to your most recent loan statement or contact your lender directly.

- Estimate Your Car's ACV: Use reliable online valuation tools like Kelley Blue Book, Edmunds, or NADAguides. Be honest about your car's condition, mileage, and features for an accurate estimate.

- Compare:

- If ACV > Loan Balance, you have positive equity. You don't need gap insurance.

- If ACV < Loan Balance, you have negative equity. Gap insurance might still be relevant, but quantify the gap.

Beyond the "Gap": What Gap Insurance WON'T Cover

It's equally important to understand the limitations of gap insurance. It's a highly specialized product, and many common misconceptions exist about what it actually protects. Gap insurance explicitly does not cover:

- Mechanical Issues: Engine failure, transmission problems, or any other repairable mechanical breakdown. It's not an extended warranty.

- Injuries, Death, or Funeral Costs: These fall under medical payments or bodily injury liability coverage.

- Your Collision or Comprehensive Deductible: You'll still be responsible for paying your deductible before your primary insurer's payout.

- A Down Payment for a New Car: Gap insurance doesn't help you buy your next vehicle.

- Credit Insurance Charges: These are separate financial products.

- Carry-over Balances from Previous Loans: If you rolled negative equity from an old car into your new car loan, gap insurance generally won't cover that rolled-over portion; it only covers the gap on the current vehicle's loan.

- Extended Warranties or Service Contracts: These are separate products you might have purchased.

- Lease Penalties: Fees for exceeding mileage limits, excessive wear and tear, or early termination.

- Overdue Payments or Late Fees: Gap insurance doesn't forgive your payment history.

- Security Deposits: On a lease, your security deposit is a separate matter.

- Repairable Damage: Gap insurance only kicks in if your car is declared a "total loss" – meaning the cost of repairs exceeds a certain percentage of its value (which varies by state) or if it's deemed economically unrepairable. It won't pay for dented fenders or a broken headlight if the car can still be fixed.

Understanding these limitations reinforces why gap insurance is a narrow solution for a specific problem—negative equity in a total loss situation—and not a general financial safety net for your car.

The Cost Factor: Dealer vs. Insurer (And Why to Be Wary)

The cost of gap insurance can vary wildly, and where you buy it significantly impacts its value proposition.

- From Your Car Insurance Company: This is almost always the most affordable option. Many major insurers, including American Family, Liberty Mutual, Nationwide, Travelers, Allstate, Farmers, and Progressive, offer gap coverage as an add-on to your existing policy. The average annual cost for gap insurance from an insurer is often around $40-$60 per year.

- From the Dealership or Lender: This is where costs can skyrocket. Dealerships often bundle gap insurance into your car loan, sometimes charging hundreds of dollars, potentially up to $600 or more for the entire term. When rolled into your loan, you also end up paying interest on the gap insurance itself, making it even more expensive.

- The Upshot: If you do determine that gap insurance is necessary, always compare quotes from your primary auto insurer before you even set foot in the dealership. If your current insurer doesn't offer it (e.g., Geico typically does not), shop around for an insurer that does.

When to Cancel Gap Insurance You Already Have

If you've assessed your situation and realized gap insurance is no longer worth it, don't keep paying for it! Canceling it is often straightforward and can save you money.

The Trigger Point: Positive Equity

The golden rule for canceling gap insurance is simple: when your car's actual cash value (ACV) consistently exceeds your outstanding loan balance.

- How to Confirm:

- Get an updated loan payoff statement from your lender. This will tell you your exact balance.

- Obtain an up-to-date valuation for your specific vehicle from trusted sources like Kelley Blue Book or NADAguides. Be realistic about your car's condition, mileage, and features.

- Compare the numbers. If your ACV is comfortably above your loan balance, it's time to act.

Steps to Cancel Your Gap Insurance

The cancellation process depends on where you purchased the policy:

- If Purchased from Your Auto Insurer: Contact your insurance agent or the company's customer service. They can typically remove the coverage from your policy immediately and adjust your premiums. You may receive a prorated refund for any prepaid amounts.

- If Purchased from a Dealership or Lender: This can be a bit more involved, but it's definitely doable.

- Review Your Loan Documents: Look for the specific terms regarding gap insurance cancellation.

- Contact Your Lender: Speak with their loan department. They will guide you through the process, which may involve filling out a cancellation request form.

- Understand Refunds: You might be entitled to a prorated refund if you cancel early. This refund could be applied directly to your loan principal, reducing your balance. Be persistent if you face resistance.

Don't assume your gap insurance automatically expires or cancels itself when you hit positive equity. It’s your responsibility to monitor your equity and initiate the cancellation.

Alternatives to Gap Insurance for New Car Owners

While gap insurance addresses a specific risk, other coverages can offer similar or even superior protection for new car owners, particularly if you don't want to carry gap insurance.

- New Car Replacement Coverage: As mentioned earlier, this is a strong alternative. It ensures that if your new car is totaled or stolen within a certain timeframe (e.g., the first year or two, or up to 15,000-20,000 miles), your insurer will pay to replace it with a brand-new vehicle of the same make and model. This means depreciation is essentially a non-issue.

- Better Car Replacement Coverage: Taking it up a notch, some insurers will offer to replace your totaled car with a newer or better model, often up to a certain percentage of your car's value. This is typically for car owners, not lessees.

These options can be more comprehensive than gap insurance because they often cover the entire value of a new car, rather than just the "gap" between your loan and ACV. It's always wise to discuss these options with your insurance agent to see if they are available in your state and for your specific vehicle.

Making an Empowered Decision for Your Car Loan

Deciding When Gap Insurance Is Not Worth It for your car loan boils down to a personalized assessment of your financial situation, your car's value, and your risk tolerance. It's about being informed and proactive, rather than simply accepting every optional add-on presented at the dealership.

Take the time to crunch the numbers:

- Calculate your current equity.

- Review your loan terms.

- Get quotes for gap insurance from both your insurer and, if necessary, the dealership.

- Explore alternative coverages like new car replacement.

By doing so, you'll ensure you're only paying for protection you truly need, saving yourself money and gaining peace of mind as you drive. Your car loan doesn't have to be a source of financial anxiety, especially when you understand all the levers you can pull.